© Kapiital Kapslock 2024

Platform

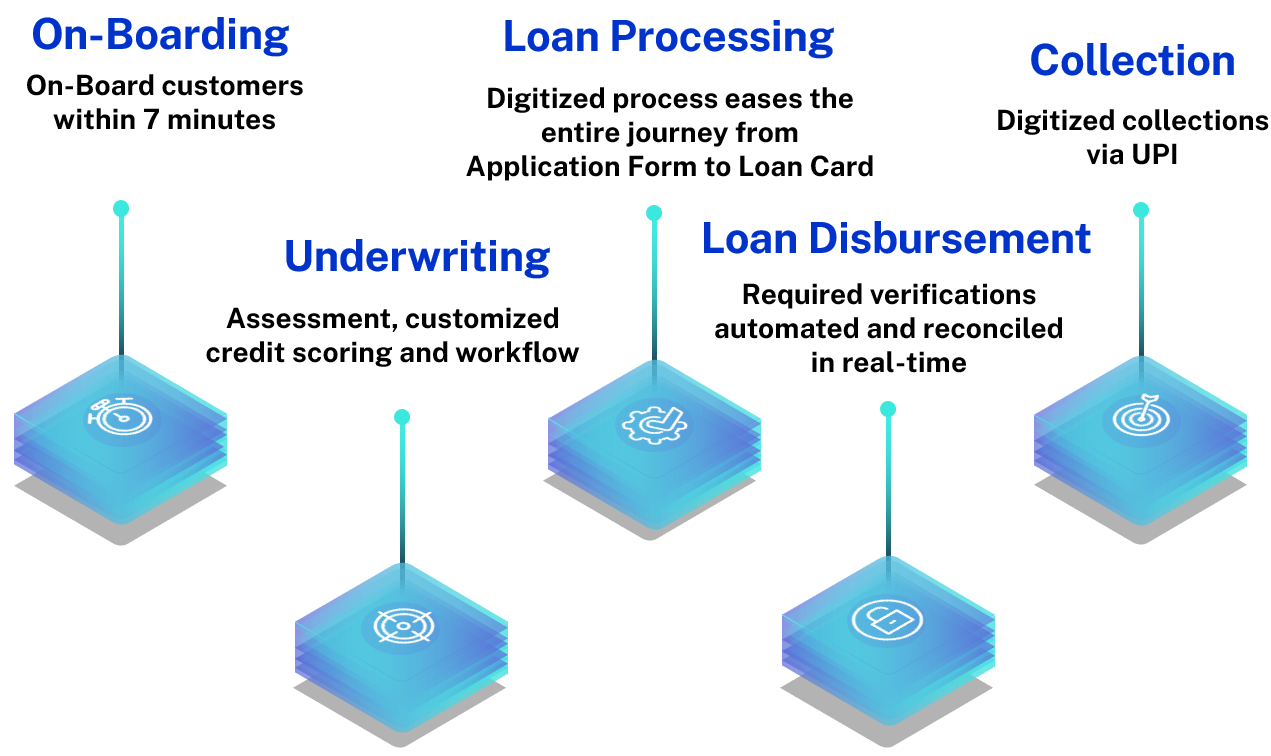

Our platform includes state-of-the-art applications that employ Machine Learning, Artificial Intelligence and Analytics to offer automated solutions for both direct and indirect lending for NBFCs, MFIs, Nidhi companies, Co-operative Societies or any other financial institutions. Our platform is designed to provide an all-encompassing solution for financial institutions. The platform supports monitoring field officer’ activities to seamlessly managing financial data and creates balance sheets and profit and loss statements.

The platform integrates:

Key Features

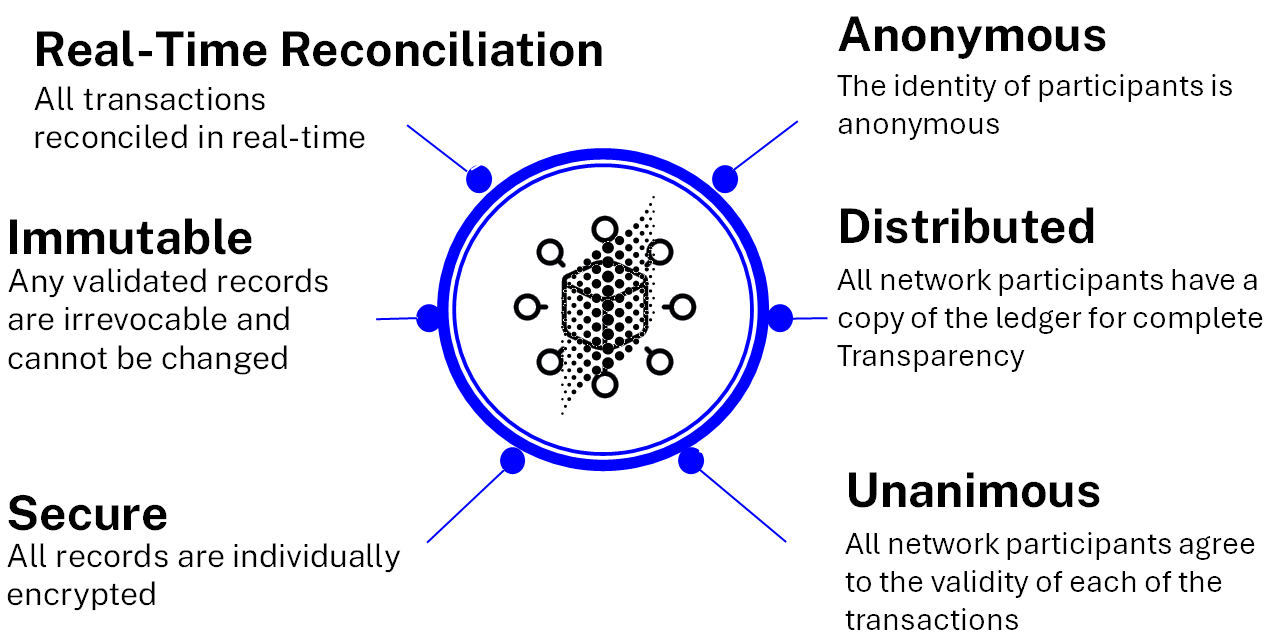

Distributed Ledger Technology

Our new, innovative, and optimized approach enables distributed ledgers to self-synchronize. It was designed from the ground-up to address the shortcomings that limit the utility of existing blockchain platforms.

The protocol creatively combines operational process controls, accounting and blockchain techniques ensuring real time settlement of all transactions. No coding for Smart contracts is required – lifecycle software drives transaction creation. There is no voting, no mining consensus or independent validators.

Our platform is equipped with a state-of-the-art credit scoring engine that enhances decision-making processes, leading to more informed and reliable outcomes. Our underwriting system is designed to streamline and optimize operations, allowing for efficient risk management while expediting loan approvals. our platform is designed to cater to this diversity, providing a range of loan options based on individual creditworthiness and values. The result is a reliable system that not only streamlines the lending process but also fosters trust and confidence among our users.